Exact Answer: 7 Years

According to the Income Tax Act of 1961, everybody whose general every year earnings is above a particular threshold is obligated to pay earnings tax. Tax submitting is the technique of calculating a tax due, growing a tax go back, and filing the finished go back to the Internal Revenue Service.

Any individual, Hindu Undivided Family also known as HUF, company, the frame of persons, affiliation of persons, or different entity that made an income withinside the previous monetary 12 months ought to report a tax return.

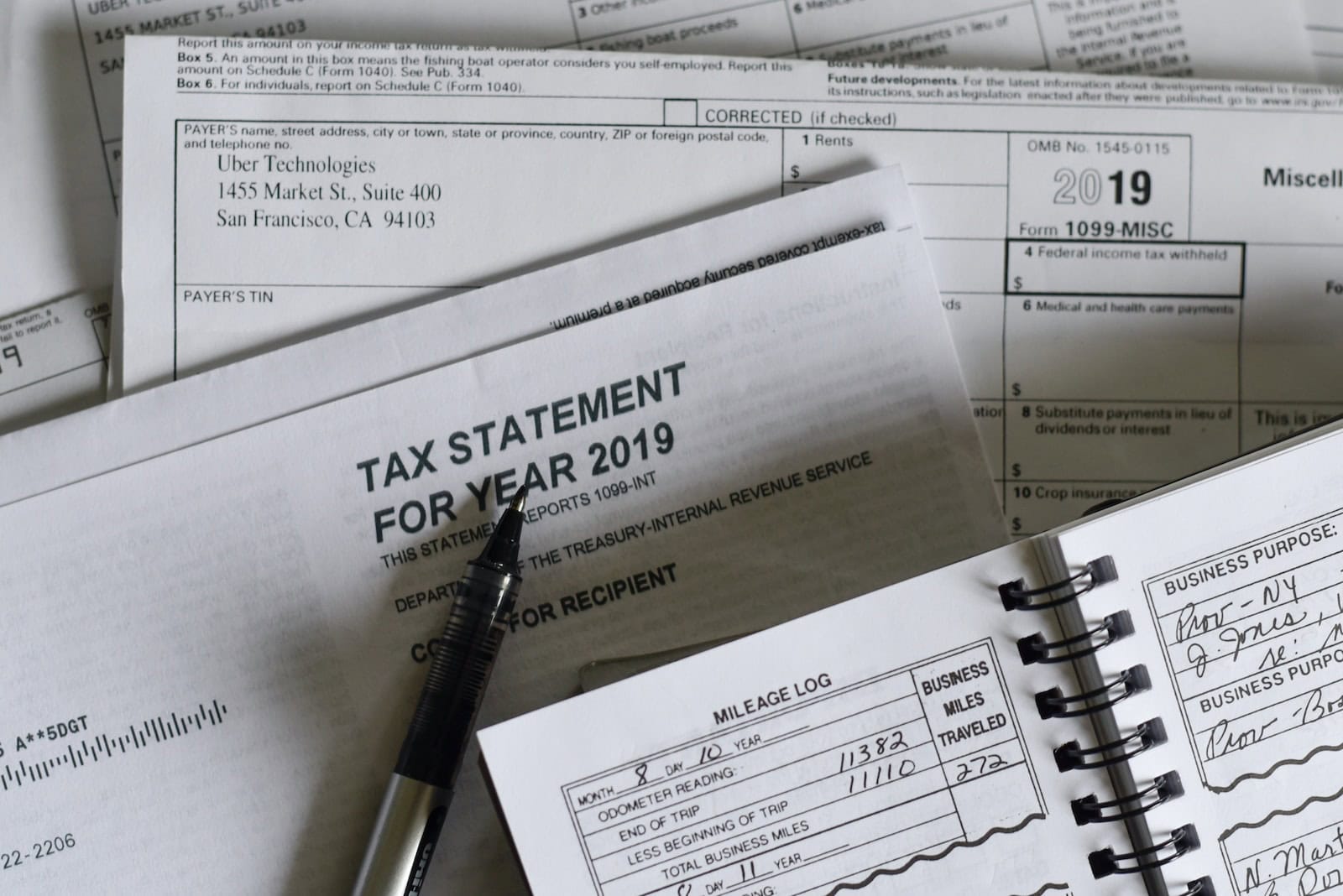

How Long To Keep Tax Returns?

It is suggested that a person should preserve his earnings and tax returns data for at least 7 years after filing. What is the purpose at the back of this? A person is ought to preserve his data for the lengthy term, even when they have accompanied the right strategies and submitted your taxes appropriately.

This is due to the fact they will need to keep their documentation available if the Income Tax Department troubles an inquiry or initiates an inquiry into your preceding returns any time in the future. The earnings tax branch has the authority to ship a notification to taxpayers for seven years after the financial year ends.

In this manner that in case someone submitted an ITR for the financial year 2019-20, they ought to preserve the helping documentation with their till the give up of the financial year 2026-27.

The earnings tax branch does have the authority to request records from preceding instances relationship returned up to 10 years, however, this best applies in times wherein the branch has proof towards a person, however, it may best be to complete it in seeking instances.

Various forms of taxpayers are included beneath the seven-year term. Whether they are salaried, self-employed, or specialists, the time frame for retaining data for seven years from the give up of the applicable economic year will be the same for all.

Summary:

| Verification | Time Taken |

| E-filling | 35-45 days |

| Tax Returns | 20-45 days |

Why To Keep Tax Returns For So Long?

How long one should keep a document depends on the activity, expense, or events it records. As a general rule, people must keep their records of income, deduction, or credit shown on their tax returns until the expiration date for that return.

A cut-off period is the period of time during which a person can change his tax return to claim a loan or refund, or the IRS can calculate additional taxes. The following information reflects the limitation period applicable to income tax returns. Unless otherwise stated, years are the period after the filing of the declaration.

Profit paid out before the due date is considered paid out on the due date. Keep copies of the filed tax returns. They will help a person to prepare future tax returns and make calculations if they file a revised tax return.

According to the IRS, the period during which a person can still amend his tax return to claim a tax deduction or refund is called the cut-off period. During this time, the IRS may still charge you additional tax liabilities. The tax office may have more time to review the state tax return than the IRS to review the federal tax return.

As a general rule, keep records of the property before the expiration of the year in which you are in charge of the property. One should keep these records for calculating depreciation, amortization, or deductions, and for calculating profit or loss on the sale or disposal of property.

Conclusion

People should always keep copies of their tax returns indefinitely. Having access to copies of the previous tax returns can help a person prepare future tax returns and calculate whether he needs to file an amended return via cloud storage and scanning.

There is no particular reason to delete old tax returns. It is recommended that people can all keep their tax returns for life on the computers without affecting the storage limits.

To be clear, one will need to keep tax records for three to seven years. To be safe without memorizing the fine print, be sure to keep the tax records for seven years. One should simplify his life, and also save their government tax records. Rules will differ from state to state, so take the time to find out how long the state expects you to keep the tax records.