Exact Answer: After 30 – 45 days

The transaction of money has always been a sizzling topic for everyone, especially when that transaction is online or in other words, through e-mediums. Even though most of the transactions in modern times are done online, still a few people hesitate about it and that’s where questions arise.

People may go nuts sometimes with online transactions, especially with the refund issue. So the government has already made guidelines regarding that. It takes 30-45 days under normal circumstances to get the refund in the bank account of the person. The process will be initiated and concluded by the department in charge with proper paper works.

How Long After Your Tax Refund Is Approved Is It Sent?

| Number of days for the money to get deposited | 30-45 days |

| Refund issue duration | 21 days |

Online modes of doing things have taken the market lately and there’s not even a little doubt about it. The world is changing and it’s for the greater purpose of it. Most of our former works using the offline mode used to take a good amount of time and consumed a lot of resources and capital.

But the online mode of doing things has made it easier. It reduces the work time and also cuts off the unnecessary expenditure. It has also made many things handy which were earlier cumbersome. E-business has also uplifted its level after digitalization. The young world depends a lot, especially on online money transactions.

Not only do online money transactions have a lot of advantages in the arsenal, but they also are fast and easy to use like a cakewalk. So normally after a certain kind of deal or shopping, the consumer or the customer pays the required amount of money to the other person affiliated with the transaction and the story ends there.

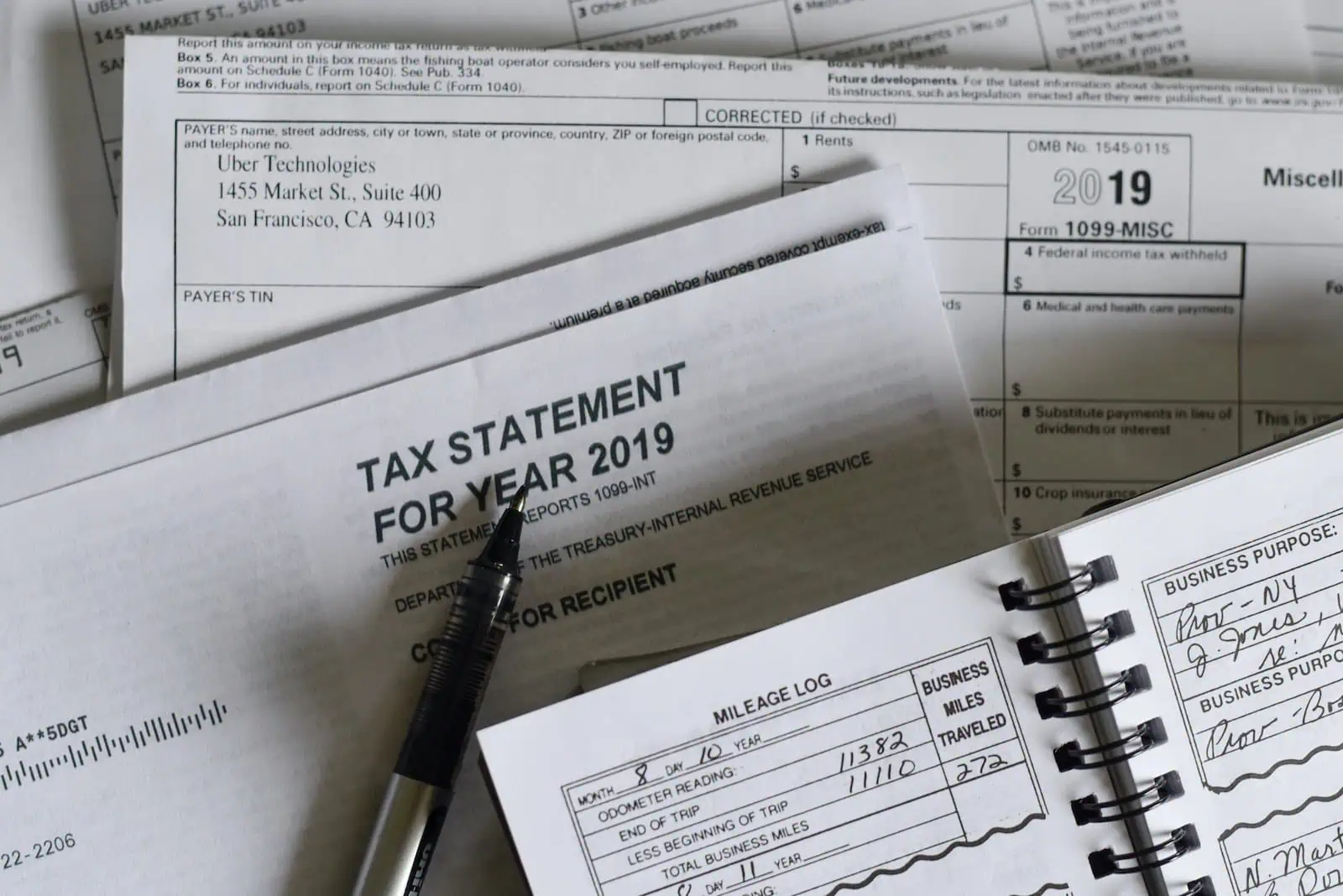

But sometimes, under special odds, the transaction may demand another transaction to compensate for the former’s fault. Such a transaction is called a refund. It is a very heard term for the online customers who buy things online on websites and markets. But the refund in online markets is not the same as the refund in tax matters. Here, there is an altogether different scenario. All these processes involve a lot of documents that are to be processed and checked properly. So, the time differs within 30-45 days.

Why Is Your Tax Refund Sent So Long After It Is Approved?

Tax payment has always been a topic of discussion over a cup of tea in the corridors of the world. Opinion regarding it varies from person to person. The opinions go biased and also unbiased as per the situation in a country and how the government is running the nation. Cutting the surface, no matter what the opinions are, it’s only rational for a citizen of any nation to pay the taxes to the government as his/her obligation towards the nation.

It is because the tax citizen pays, comes back to the person itself through government schemes and offers. How the process works is that the government collects the taxes and uses the fund to make developments in the country through various schemes and construction projects. Tax is the fund the government uses to fulfill the demands of the country’s people.

But in some cases, the tax paid may have to travel back to the person who had paid it. This is called a tax refund. It may happen due to many different reasons and it depends on the authority whether the refund will be granted or not. Though the authority also has to abide by the guidelines of the government. The refund will be issued by the Department within 21 days under the guidance of the IRS.

IRS means Internal Revenue Service. It sees over the tax issues and handles them abiding by the guidelines. After the IRS officers and staff go through their check-ups, it’s on them to decide whether the refund will be issued or not. If the documents go well, the refund gets issued and money reaches safely to the bank account.

Conclusion

If the checkup by the IRS (Internal Revenue Service) goes well and the officers in charge approve the refund, the person affiliated with the refund gets the money deposited in the bank within 30-45 days after the approval.

The department issues a legal document regarding the transaction and money is sent from one account to the person’s bank account. The person can track the refund status once it is issued by the IRS. This is how the online transaction of money works in the tax world and all the details of the cycle are given in the body of the article.