Exact Answer: After Every 45 Days

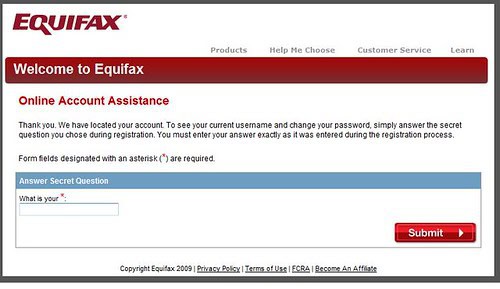

Maintaining a proper credit score and taking a balanced eye on every market is a must for a businessman to carry on the market. There are several markets available at this present time, and it becomes quite a tough job to keep a hawk-eye on every market. Hence, there are some reporting agencies, who step up forward and create an educational credit score for the provided consumers.

By studying this credit market deeply, one can easily take a brief knowledge about the estimated general credit position one can generate. In the same way, it also works with Transunion and they report millions of consumer credit over several countries. Hence, it all aggregates the credit score and provides it to the consumer.

How Long Does Transunion Update After Equifax?

| Time Taken To Update After Paying Off Debt | 1 To 2 Months Average |

| Time Taken For Credit Score Increase | 30 To 45 Days |

Although it is reported in some cases that, it may take up to some months for the proper update of the credit score both in Equifax and Transunion. Still, it is mostly seen that the credit score gets updated perfectly within 30 to 45 days of paying off the debt. Once the months end without any fuss in the credit market, all the credit score gets listed in the Equifax within a month.

Once it gets updated within it, it gets checked by the government officials and the bureaus every month. It gets verified once the original statement is generated on the monthly account. The major money lenders who take a lot of stake in the whole market most report to the bureau promptly. It doesn’t really matter that your Equifax and the Transunion both would have the same credit score simultaneously. It can differ in consent from the lender reporting to the different bureaus differently.

Although the credit score can be managed without any cost in the Trans union, if you pay for the subscription, it would be more fruitful. By having a paid subscription, one can easily get the improvised credit score and it can also help in gaining the power to improve credit health.

It can also allow you to identify the data present in the credit and can also give you access to get an approach towards the credit with a lot of confidence. However, how different both business major credit bureaus sound, it is a time span of barely a month, which is a must for the update.

Why Does It Take So Long After Transunion Update For Equifax?

Although it is said that, it takes almost a month for Equifax to update after the update is done by the Transunion. Still, it is not that easy to get the update done, in some cases when there arise some complications. According to the research held by the Institute of Counter Marketing Strategy, there are several reasons which can delay the update of the market score by 18%. These causes include lack of integrity within the major bureaus, and knowingly trying to ignore the basics stages of updating the data.

Some bureaus love to work independently during this calculation of market scores. But at the end of the month, it is the central bureau to which one must submit all the scores for the verification, which is totally necessary. However, at this stage, the bureaus start ignoring the last time submission and there occurs the lack of integrity. This lack of integrity generates the market score or the credit score to delay the update.

Although the central bureau makes it very clear of submitting the credit score of different bureaus within the given period of time, still it becomes too complicated when they knowingly try to stretch it long. While comparison it is mostly seen that, the credit score of Transunion is always a little higher than Equifax.

It is believed to be at a higher rate because the report which gets reported to their credit reporting agency differs a little from the others. The other causes which make all this differs also because the Transunion counts all the employment backups and all the history one has and also the personal information of the person.

Conclusion

Due to the different scoring models present in the market, one may also get a lot of differences between the scores of Transunion and Equifax. Sometimes it is accounted that the Transunion scores take an upwards slide, while the Equifax takes a higher dip towards the lower end. However, one’s payment history can affect the whole credit score of someone, if it is through the Transunion.

But whatever it is, it never gets updated in a sudden go after one pays off the debt. It takes a lot of effort and patience to see a spike in the credit score after paying off. And normally this time is calculated for a month or a month and a half.

The delay in updating credit scores between Transunion and Equifax is quite frustrating for consumers. It seems like there should be a more efficient process in place.

Absolutely, the discrepancies in credit scores can have significant impacts on financial opportunities.

The differences in credit reporting between Transunion and Equifax highlight the complexities of the credit scoring system. This information is valuable for consumers navigating the financial market.

The impact of credit scores on financial opportunities cannot be underestimated. This analysis provides valuable insights.

Absolutely, understanding the nuances of credit reporting is essential for informed decision-making.

The differences in scoring models and the potential delays in updating credit scores highlight the need for comprehensive reforms in the credit reporting system. Consumers rely on accurate and timely information for their financial well-being.

The complexities of credit scoring and the potential discrepancies between bureaus underscore the importance of transparency and accuracy in credit reporting.

Absolutely, the nuances of credit scoring have far-reaching implications for consumers’ financial stability.

The analysis of credit score updates and the discrepancies between bureaus sheds light on the complexities of the credit reporting system. It’s a critical issue for consumers.

Absolutely, understanding the nuances of credit reporting is essential for financial literacy.

Indeed, the intricacies of credit scores have a direct impact on financial well-being.

The disparities in credit scores and the time taken for updates raise important questions about the credit reporting system. Consumers need accurate and timely information to make informed financial decisions.

Indeed, the complexities of credit scoring require careful consideration for financial planning and stability.

The impact of credit scores on financial opportunities cannot be underestimated. This analysis provides valuable insights for consumers.

The reasons for the delay in updating credit scores are concerning. It’s important for the bureaus to maintain integrity and accuracy in their reporting.

Agreed, consumers rely on accurate credit scores for their financial stability.

The lack of integrity within the bureaus is a serious issue that needs to be addressed.

The complexities of credit scoring and the potential delays in updates present challenges for consumers. It’s crucial for bureaus to prioritize accuracy and efficiency in reporting.

Absolutely, the credit reporting system plays a significant role in financial decision-making and stability.

The impact of credit scores on financial well-being underscores the importance of transparent and efficient reporting.

The differences in scoring models between Transunion and Equifax can lead to confusion and uncertainty for consumers. It’s essential to have transparency in reporting.

Absolutely, clarity in credit reporting is crucial for consumers to make informed decisions.

This is an excellent analysis of the credit reporting agencies and the process of updating credit scores. It’s important for consumers to understand the timeline for updates and the differences between Transunion and Equifax.

I agree, it’s crucial to have this knowledge for financial planning and decision-making.

The differences in credit scores between bureaus and the potential delays in updates can have significant implications for consumers. It’s essential to have clarity and accuracy in credit reporting.

The challenges with credit score updates highlight the need for improvements in the reporting process.

Absolutely, transparency in credit reporting is crucial for consumer confidence and informed decision-making.